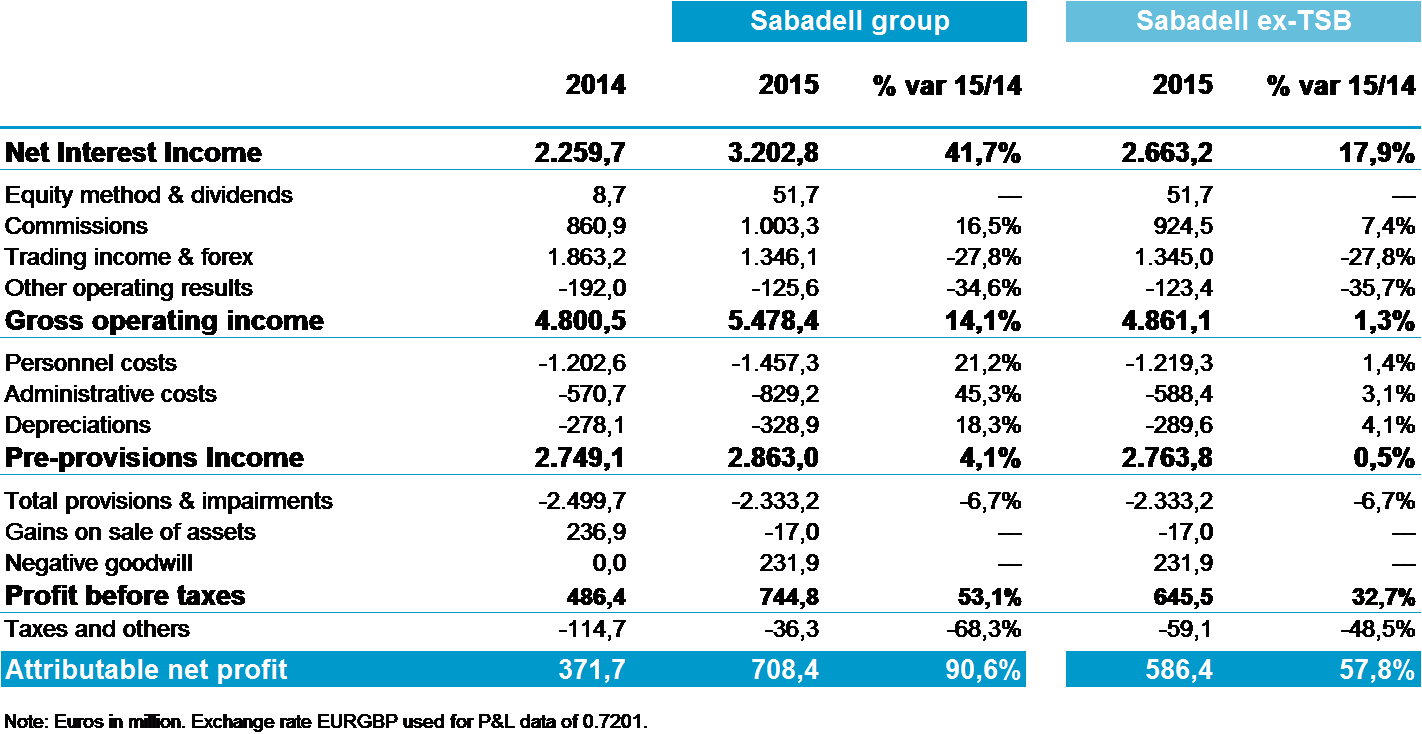

The Banco Sabadell group increased net attributable profit by 90.6% in 2015, to €708.4 million, beating market consensus estimates. The group has been consolidating TSB Banking Group in the UK ("TSB") since 30 June 2015. Excluding TSB, Banco Sabadell's profit amounted to €586.4 million, a 57.8% increase year-on-year in like-for-like terms.

Banco Sabadell's results reveal strong net interest income boosted by lower funding costs—both customer deposits and capital markets—despite low interest rates. Net interest income increased by 41.7% in 2015, to €3,202.8 million. It also increased sequentially, by 2.3% in the fourth quarter to €962.5 million. Excluding TSB, the increase would have been +17.9% year-on-year and +2.4% quarter-on-quarter. The customer spread was 2.59% in 2015 excluding TSB (2.75% with TSB), compared with 2.35% in 2014; that is one of the largest spreads in the Spanish banking sector.

A total of 32% of the loan book is located outside Spain.

In 2015, Banco Sabadell fulfilled all the objectives for the second year of its TRIple 2014-2016 business plan, which is focused on Transformation, Profitability and Internationalisation. It was the year in which Banco Sabadell acquired TSB; this milestone, coupled with the establishment of a bank in Mexico and the presence in Colombia and Peru, resulted in 32% of the loan book being located outside Spain, exceeding the estimates under the business plan.

Banco Sabadell ended the year with a strong capital position. The fully loaded CET1 ratio was 11.4%, well above the regulatory requirement (9.25%). That is the second-lowest ratio required of a Spanish bank, evidencing that the ECB attributes a low level of risk to Banco Sabadell.

Income from financial transactions amounted to €1,208.2 million in 2015, a 31.5% decline year-on-year due to the fact that 2014 included €1,860.7 million in gains on the sale of available-for-sale fixed-income financial assets.

The bank booked €2,333.2 million in provisions in 2015, 6.7% less than in 2014, and €377.9 million in the fourth quarter.

Fee and commission performance was strong, and asset quality improved substantially in 2015. Additionally, growth in the business resulted in an increase in managed funds and market share.

Sabadell Inversión, the fastest-growing fund manager in 2015

Fee and commission revenues continued to rise, boosted by the marketing of mutual funds, pension funds and insurance products, and by asset management fees. The volume of assets in mutual funds expanded steadily, to €21,427.3 million at 31 December 2015, a 36.4% increase year-on-year.

Fund manager Sabadell Inversión increased assets under management by €3,135 million, according to Inverco figures. It was the fastest-growing fund manager in Spain in 2015, increasing the bank's market share in this segment to 6%, from 5.1% in 2014.

Overall, net fees and commissions amounted to €1,003.3 million in 2015, an increase of 16.5% year-on-year and 0.4% in the fourth quarter alone. Excluding TSB, net fees and commissions amounted to €924.5 million in 2015, an increase of 7.4% year-on-year and 2.0% quarter-on-quarter.

At the end of 2015, on-balance sheet customer funds amounted to €131,489.2 million (€96,227.0 million excluding TSB), a 39.2% increase year-on-year (1.9% excluding TSB).Off-balance sheet customer funds amounted to €37,381.1 million, a 23.0% increase year-on-year. Gross loans and advances to customers, excluding repos and doubtful assets, amounted to €140,226.4 million as of 2015 year-end.

Outstanding loans (i.e. gross loans and advances, excluding TSB and net of repos and doubtful assets) continued to rise, having increased by 2.1% in 2015 to €104,380.9 million. New mortgage production is advancing at a good pace, having increased by 39% year-on-year to €2,443 million, while the number of deals rose by 24.6%.

Market shares continue to increase in all segments. In banking to companies, Banco Sabadell's share of documentary credit reached 30.45% in 2015. The bank's share of POS turnover also rose substantially, to 17.91% (from 14.54% in 2014), while its share of loans increased to 11.20% (from 10.56%). Market share also expanded in all segments of personal banking: credit cards, to 8.22% (from 7.64% in 2014); life insurance, to 5.10% (4.17%); and household deposits, to 5.75% (5.31%).

The non-performing loan ratio fell to 7.79% and the volume of problematic assets is being reduced faster than expected

The NPL ratio continued to decline in the quarter due to the sharp reduction in doubtful balances, while reserves for problematic assets increased to comfortable levels. The ratio was 7.79% at year-end, down from 8.51% three months earlier; excluding TSB, the ratio fell to single-digits: 9.86%. Overall, non-performing loans were reduced by €3,565.7 million in 2015, excluding TSB (€5,383 million since the first quarter of 2014), and €778.0 million in the fourth quarter. As of 2015 year-end, the Banco Sabadell group had €12,344.2 million in doubtful exposures.

The bank is reducing its volume of problematic assets faster than envisaged in the TRIple plan. Banco Sabadell reduced its volume of problematic assets by €3,179.7 million in 2015, and by €771.3 million in the fourth quarter. As of 2015 year-end, the Banco Sabadell group had €21,578.6 million in problematic assets.

In total, 10,949 units were sold in 2015 at a discount of 44% on their gross value, down from 51% in 2014. Banco Sabadell enters 2016 with a portfolio of 4,500 residential units for sale, worth a total of €550 million, which it expects to sell in the first quarter of the year. Investor appetite for Spanish real estate continues to improve, leading to a reduction in the discount offered on the gross asset value.

The coverage ratio also improved, to 53.64% at 2015 year-end (53.10% excluding TSB), compared with 49.44% at 2014 year-end. The cost-to-income ratio improved to 50.45% at the end of December 2015 (46.16% excluding TSB) compared with 53.14% at the end of 2014.

Best mobile banking app for Apple and Google for the fourth consecutive year

Banco Sabadell is a multi-channel bank focused on long-term relations based on its leading position to customer experience; for this reason, part of employees' variable remuneration depends on the Net Promoter Score (NPS), which measures customers' satisfaction on the basis of their willingness to recommend the bank to someone else.

The intensity with which the channels are used varies between segments: more traditional customers prefer face-to-face banking at the local branch; younger and more mobile customers (e.g. self-employed workers) prefer mobile devices and the web. We offer a range of channels and approaches (e.g. Gestión Activa) so that customers can choose the ones that suit them best, without impacting our profitability.

At present, 40% of our customers are digital and BSMóvil has been the top-rated mobile banking app in the Apple and Google app stores for the last four years. We are market leaders in digital capabilities and internet presence, as evidenced by the latest Kanvas Media report (December) on bank brand value in Google.

Integration of TSB is proceeding on schedule

In 2015, TSB reported £105.7 million in pre-tax profit, excluding extraordinary items, on £781.3 million in net interest income. In the fourth quarter, the franchise improved net interest income by 1.5% with respect to the third quarter due to higher volumes and lower costs.

The process of integrating TSB with Sabadell's technology platform is advancing on schedule. TSB's business plan is also being implemented as planned, including a sizeable increase in mortgage brokerage volume due also to the acquisition of the UKAR asset portfolio; moreover, the NPS customer satisfaction index continues to improve, exceeding the targets.

Looking to the future with optimism due to strong revenue performance

Banco Sabadell expects 2016 to be a year in which asset quality begins to normalise and the TRIple strategic plan is completed successfully, since the Transformation, Profitability and Internationalisation goals for 2015 have been achieved.

The bank is already working on its strategy for 2017-2019, which will be supported by strong revenue sources. The new plan will be driven by the continued reduction of problematic assets at a good pace in order to restore on-balance sheet asset quality to normal in the framework of a recovery in the real estate market. Banco Sabadell also continues to target double-digit ROTE.

Digitalisation of the business will continue to drive the bank's financial project, while it strengthens its bank in Mexico and adds value to TSB in the UK by fully migrating it to the IT platform and focusing on the SME market in the UK.

Other key developments in 4Q15

Latest recommendations

A number of research houses, such as KBW and Barclays, began the year by upgrading their view of the bank. Experts note that the ECB has imposed one of the lowest capital requirements in Spain on Banco Sabadell and they view the TSB acquisition as a smart deal and a key differentiating factor vis-à-vis domestic rivals. They expect the real estate market to continue to improve in 2016, and the bank's credit quality to improve also.

Dividends

On Thursday, 28 January 2016, the Board of Directors of Banco Sabadell resolved to propose the following to the next Ordinary Shareholders' Meeting: the payment of flexible shareholder remuneration (scrip dividend) amounting to €0.05 per share, implemented in the form of a bonus issue of shares charged to voluntary reserves, offering shareholders the possibility of receiving that amount in new shares and/or in cash, by selling their rights to free assignment to the Bank by virtue of the purchase commitment to be made by the Bank; and a supplementary dividend amounting to €0.02 per share, paid in the form of shares out of the Bank's treasury stock.

Comfortably exceeding the European Central Bank's capital requirements

Banco Sabadell has a fully loaded CET1 ratio of 11.4%, well above the 9.25% required under the ECB's SREP. That regulatory requirement is the second-lowest imposed on a Spanish bank, evidencing that the ECB views Banco Sabadell as low risk.

New branch configuration

The hub branch project is based on specialisation and commercial productivity. This model, which has been piloted in all territories, will be used in 2016 to enhance service to over 900,000 customers by applying it to over 460 branches and the 2,300 employees who work in them. The model revolves around a "central branch" with the full range of capacities and products which serves a number of satellite branches that are specialised in customer needs.

Client experience based on NPS in the UK

Banco Sabadell measures customer experience with the Net Promoter Score (NPS), which determines customer satisfaction on the basis of willingness to recommend the bank to another person. The bank's firm commitment to building long-term relationships with its customers is driven by its leadership in customer experience. For that reason, part of employees' variable remuneration depends on the NPS.

Commencement of operations in Mexico

In December 2015, Banco Sabadell achieved certification by Mexico's National Banking and Securities Commission and fulfilled the requirements of the Bank of Mexico. The new bank in Mexico, which obtained its bank licence last August, has been engaging in corporate and SME banking since 4 January 2015 and will launch personal banking later this year.