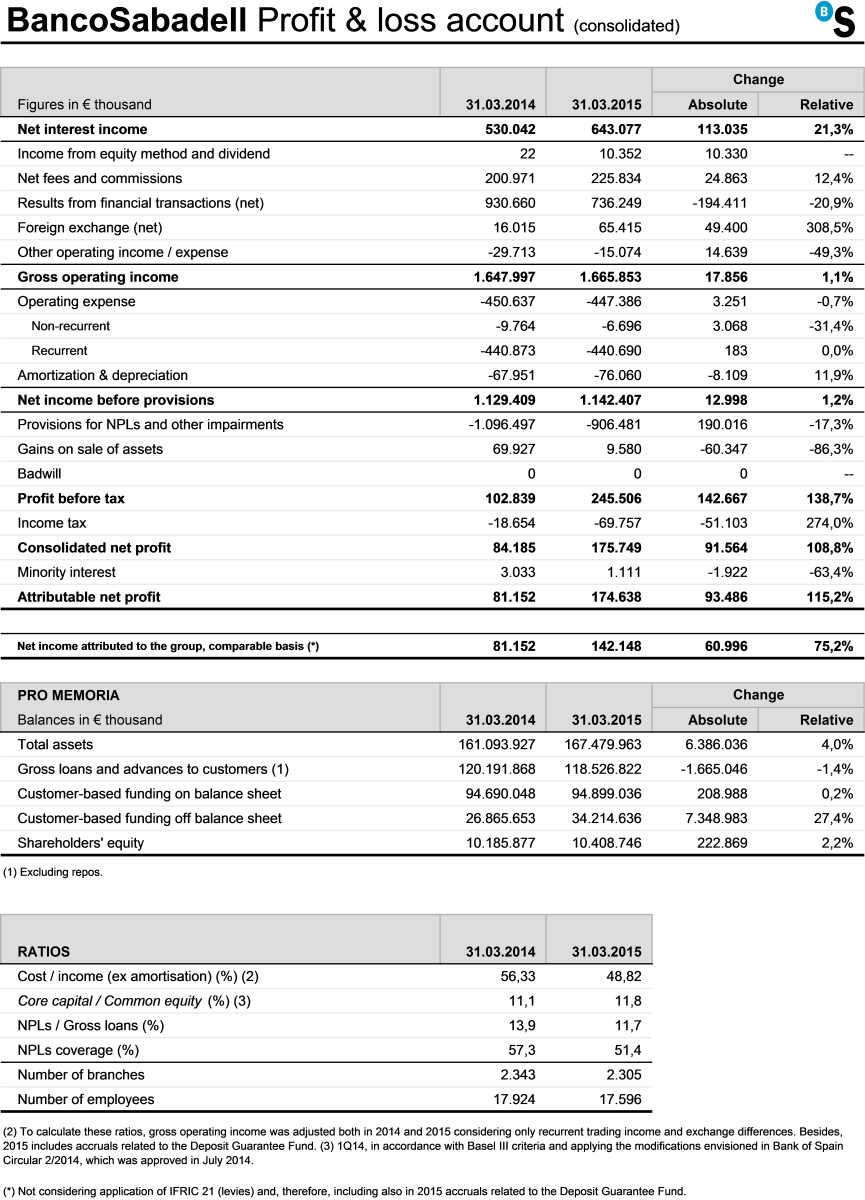

Non-performing loans declined by a record 1,047 million euro. The NPL ratio declined by 106 basis points in the first three months of the year, from 12.74% to 11.68% currently, and the doubtful asset coverage ratio was 51.4%.

Net interest revenues, which have increased steadily for the last seven quarters, rose by 21.3% in the first quarter in year-on-year terms.

New mortgage production increased by 66% year-on-year. Net commercial loans expanded for the fourth consecutive quarter, increasing by 7.1% in the last twelve months.

Customer funds increased by 6.2%. Off-balance sheet customer funds increased by 27.4% year-on-year. Assets in mutual funds and investment companies expanded by 51.6%.

At the end of the first quarter, Banco Sabadell group's key balance sheet and income statement figures reflect the positive impact of the Triple Plan and the bank's accelerating progress quarter on quarter, outstripping market consensus expectations.

As of 31 March 2015, attributable net profit amounted to 174.6 million euro, 115.2% more than in the same period last year, after applying IFRIC 21 on accounting for levies. This result was obtained after allocating 906.5 million euro to provisions for NPLs, the securities and real estate portfolio, and other contingencies.

If IFRIC 21 had not been applied and, therefore, the contribution to the Deposit Guarantee Fund was being accrued in 2015, net attributable profit in the first quarter of 2015 would have amounted to €142.1 million (+75.2% y/y).

The first quarter was marked by the outstanding performance of customer funds, stronger demand for loans (especially among SMEs), and a faster pace of reduction in the portfolio of problem assets; Banco Sabadell also launched a takeover bid for UK bank TSB and a rights issue for 1,600 million euro.

Balance sheet

At the end of the first quarter of 2015, Banco Sabadell and its group had 167,480.0 million euro in total assets, i.e. 4.0% more than a year earlier.

Lending

Gross loans and advances to customers amounted to 118,526.8 million euro, i.e. almost 71% of the group's total consolidated assets. In the first quarter of 2015, lending increased by 1.5% (1,561.6 million euro), confirming the revival observed in preceding quarters. Excluding doubtful balances, gross lending increased by 0.8% y/y (-1.4% including doubtful balances).

Mortgage loans, the largest single component of gross lending (approximately 48%), amounted to 56,948.1 million euro at 31 March 2015. New mortgage production increased by 66% year-on-year. Net commercial lending increased for the fourth consecutive quarter, especially to companies, and is up 7.1% in the last twelve months.

In the first three months of 2015, the Banco Sabadell group's ratio of non-performing loans to total computable risks improved by 106 basis points to 11.68% (vs. 12.74% as of 31 December 2014).

In the same period of 2015, NPLs declined by 1,047 million euro and the reduction in the portfolio of problem assets accelerated. The NPL coverage ratio was 51.4%, compared with 49.4% as of 31 December 2014.

The sale of real estate on the balance sheet via Solvia amounted to 3,123 units at 31 March, positioning Solvia as one of the main property servicers in Spain, managing 26,000 assets, 46% of which was adjudicated by SAREB.

Customer accounts

Customer funds increased by 6.2% in the first quarter. Customer funds on the balance sheet expanded by 0.2% year-on-year to 94,899.0 million euro.

The balance of demand deposits increased by 22.6% to 45,479.8 million euro. Time deposits amounted to 50,560.6 million euro, down 16.7% compared with 31 March 2014, as savers have shifted towards other types of investment with greater potential returns in the current context of low interest rates.

Off-balance sheet customer funds amounted to 34,214.6 million euro, a 27.4% increase compared with the first quarter of 2014.

Within this item, the balance of assets in collective investment institutions continued to rise, to reach €18,673.6 million as of 31 March 2015, i.e. an increase of 51.6% year-on-year and of 18.9% with respect to the beginning of the year, particularly in higher margin products. The market share was 5.36% (4.53% in March 2014).

The balances of assets under management also increased considerably, to 3,791.3 million euro (+67.7% y/y).

Total funds under management amounted to 156,128.4 million euro as of 31 March 2015, i.e. 3.9% more than the balance of 150,200.5 million euro as of 31 March 2014.

Banco Sabadell's brand awareness vis-à-vis SMEs increased in 1Q15, and it maintained its position as an industry leader in quality with 7.51 points, i.e. higher than the average for banks (6.73 points), according to an objective quality survey of bank branch networks by Stiga in the first quarter.

Margin and profit performance

At 31 March 2015, the margins obtained from the ordinary banking business performed as expected due to the lower cost of funds and despite narrowing of lending spreads.

Net interest income, which continues to expand, amounted to 643.1 million euro, after increasing by 21.3% in the last twelve months. The customer spread stood at 2.44% (2.35% in 4Q14) and the margin on average total assets reached 1.57% (1.49% in 4Q14).

Dividends received and results from equity-accounted affiliates together increased considerably in year-on-year terms to 10.4 million euro in the first quarter of 2015. Those revenues are due mainly to the insurance and pension fund business.

The favourable performance of off-balance sheet funds and the increase in cross-selling of products and services, especially among the group's new customers, resulted in a 12.4% y/y increase in general (225.8 million euro), in risk transactions and the provision of services such as those related to mutual fund management and insurance and pension fund sales.

Income from financial transactions amounted to 736.2 million euro, including notably gains from active management of the fixed-income portfolio.

Net exchange gains increased due to greater transaction volume, to 65.4 million euro. Operating expenses amounted to 447.4 million euro in the first quarter of 2015, a slight decline (-0.7%) in year-on-year terms.

Once again, the cost:income ratio improved, to 48.82% in the first quarter of 2015 (vs. 56.33% in 1Q14), advancing towards the 40% objective envisioned in the Triple Plan for 2016 year-end. For the purposes of year-on-year comparison, extraordinary gains on financial transactions and exchange differences have been removed, and the contribution to the Deposit Guarantee Fund that will be booked in December 2015 is being accrued.

Consequently, net profit before provisions amounted to 1,142.4 million euro in the first quarter of 2015, a 1.2% increase year-on-year. Excluding trading income and exchange differences in both years, the year-on-year variation in pre-provision profit was +86.5%.

Provisions for loan losses and other impairments to the real estate and financial asset portfolio, plus other contingencies, amounted to 906.5 million euro (17.3% lower compared with 1Q14).

After applying capital gains on asset sales (9.6 million euro), deducting income tax and the amount corresponding to non-controlling interests and applying IFRIC 21, net attributable income in the first quarter amounted to 174.6 million euro.

At the end of 1Q15, Banco Sabadell was among the most solvent banks, with a Core Equity Tier 1 ratio of 11.8%, or 11.7% in accordance with Basel III "fully loaded", which is envisioned for 2018. The BIS ratio was 12.8% (12.1% in March 2014).

Takeover bid for TSB Banking Group

On 19 March 2015, the Board of Directors of Banco Sabadell approved unanimously the presentation of a tender offer for TSB Banking Group plc, the sixth-largest banking group in the UK, which was formalised on 17 April.

The price of the offer was 340 pence per share, valuing the entire capital of TSB at approximately 1,700 million pounds sterling. The bid has the support of the Board of Directors of TSB, which recommended that its shareholders accept it as it considered it in the best interests of their customers and employees.

TSB has been operating in the UK for more than 200 years, and is well-established with a strong relationship with its customers. It is a commercial bank resulting from a spin-off of Lloyds banking group, with a very strong focus on customers and a commercial infrastructure that accounts for 6.1% of the UK market. It currently has assets in excess of 34,000 million euro and a network of 631 branches throughout the UK, which serve 4.6 million customers.

Rights issue

Coinciding with the friendly takeover bid for TSB Banking Group plc, and with a view to maintaining Banco Sabadell's fully-loaded capital ratio unchanged, on 19 March the Board of Directors approved a rights issue for a total gross effective amount of at most 1,606,556,169 euro.

Following the completion of the pre-emptive subscription period, which began on 28 March, the rights issue concluded on 17 April. As a result, 1,085,510,925 ordinary shares of the bank will be placed in circulation on Tuesday, 28 April. The new shares represent 26.970% before the capital increase and 21.241% after the capital increase.

The issue was underwritten by a bank syndicate coordinated by Goldman Sachs International, which included J.P. Morgan Securities plc, Deutsche Bank AG and Nomura International plc.